How Dubai Company Expert Services can Save You Time, Stress, and Money.

Wiki Article

The smart Trick of Dubai Company Expert Services That Nobody is Discussing

Table of ContentsA Biased View of Dubai Company Expert ServicesLittle Known Questions About Dubai Company Expert Services.Dubai Company Expert Services Things To Know Before You BuyDubai Company Expert Services Fundamentals Explained3 Simple Techniques For Dubai Company Expert Services

As the little boy stated when he left his very first roller-coaster ride, "I like the ups however not the downs!" Right here are a few of the dangers you run if you intend to start a local business: Financial risk. The funds needed to begin as well as grow a company can be comprehensive.People typically begin services so that they'll have more time to invest with their families. Running a service is very lengthy.

6 "The Business owner's Workweek" (Dubai Company Expert Services). Vacations will certainly be difficult to take as well as will certainly commonly be disturbed. Over the last few years, the problem of avoiding the task has actually been compounded by cellular phone, i, Phones, Internet-connected laptop computers as well as i, Pads, and several local business proprietors have actually concerned be sorry for that they're constantly reachable.

Some people recognize from an early age they were suggested to own their very own company. There are a number of advantages to starting a service, yet there are likewise takes the chance of that need to be examined.

Excitement About Dubai Company Expert Services

For others, it might be conquering the unidentified as well as striking out on their very own. You define personal satisfaction, starting a new business may hold that assurance for you. Whether you view starting an organization as an economic necessity or a way to make some added earnings, you could find it generates a new income.Have you assessed the competition and considered just how your certain service will prosper? Describe your company goals. What do you intend to complete as well as what will you think about a success? Another big choice a little business proprietor deals with is whether to own business directly (sole proprietorship) or to form a separate, statutory company entity.

A benefit firm is for those service proprietors who intend to earn a profit, while likewise serving a charitable or socially beneficial mission. You can create your service entity in any kind of state however proprietors commonly choose: the state where the business lies, or a state with a preferred controling statute.

Make certain the name has words or acronyms to suggest the entity kind. Ensure it does not have any forbidden or limited words or expressions. The entity can be a different taxable entity, indicating it will certainly pay revenue tax obligations by itself income tax return. Dubai Company Expert Services. The entity can be a pass-through entity, meaning the entity doesn't pay the taxes yet its revenue passes through to its proprietor(s).

Top Guidelines Of Dubai Company Expert Services

Sole traders and also companions in a partnership pay approximately 20% to 45% revenue tax obligation while business pay corporation tax obligation, normally at 19%. resource As long as company tax rates are reduced than income tax obligation rates the advantage will certainly typically be with a limited firm. Along with salary payments to staff members, a firm can additionally pay returns to its investors.Provided a minimum level of salary is taken, the director keeps entitlement to certain State advantages without any kind of staff member or company National Insurance policy Contributions being payable. The equilibrium of compensation is in some cases taken as dividends, which may suffer much less tax obligation than income and also which are not themselves based on National Insurance Contributions.

This may be beneficial when the withdrawal of additional income this year would certainly take you into a greater tax obligation bracket. You ought to always take expert tax or financial advice in the light of your specific conditions, as well as this location is no exception. No guidance is used below.

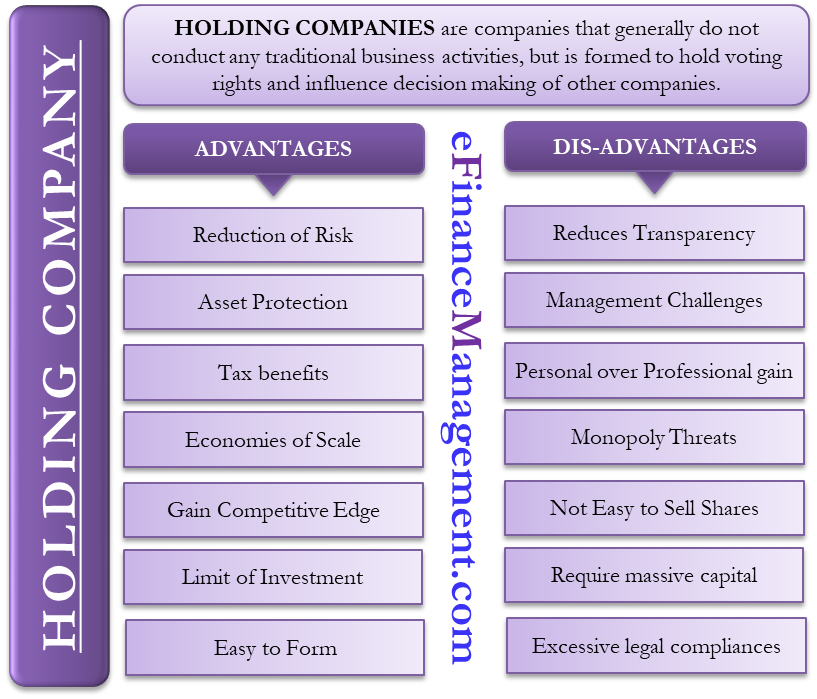

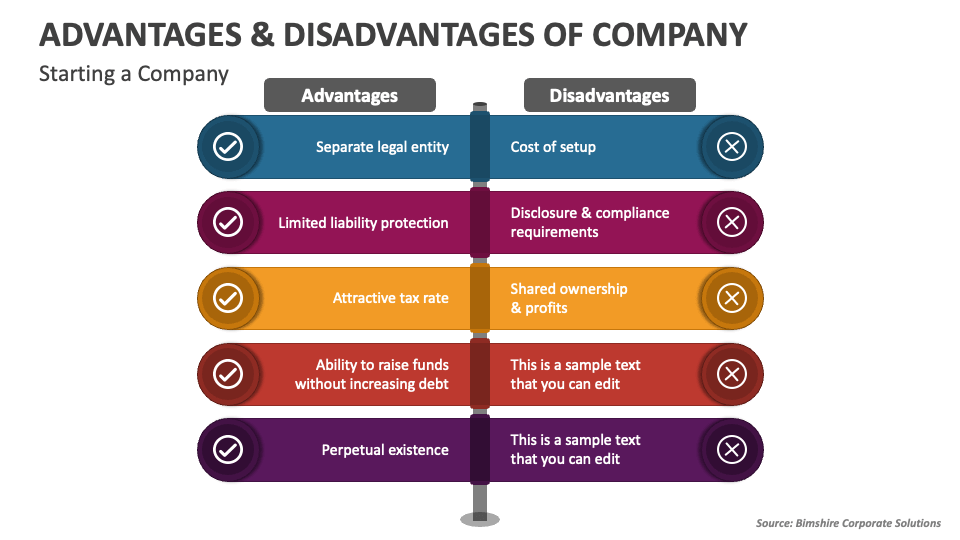

One of the most common types of companies are C-corps (dual tired) and also S-corps (not dual strained). Benefits of a company consist of individual responsibility defense, organization security and continuity, and easier access to capital. Drawbacks of a company include it being lengthy as well as based on double taxation, in addition to having stiff procedures and also methods to follow.

Rumored Buzz on Dubai Company Expert Services

One choice is to structure as a company. find There are several factors why integrating can be advantageous to your service, there are a few disadvantages to be mindful of. To assist you establish if a company is the very best lawful framework for your business, we spoke to legal specialists to break down the various kinds of companies, as well as the benefits and downsides of including.For lots of companies, these demands include developing business laws and also declaring articles of consolidation with the secretary of state. Preparing all the info to submit your write-ups of incorporation can take weeks or even months, but as quickly as you have actually efficiently submitted them with your assistant of state, your business is officially recognized as a company.

Firms are generally regulated by a board of directors chosen by the investors."Each owner of the company normally has a percentage of the company based on the number of shares they hold.

A corporation gives a lot more personal asset responsibility defense to its proprietors than any type of other entity kind. If a company is taken legal action against, the investors are not personally liable for company financial obligations or legal responsibilities even if the corporation does not have sufficient cash in possessions for settlement. Personal responsibility security is one of the major reasons businesses select to incorporate.

An Unbiased View of Dubai Company Expert Services

This access to financing is a high-end that entity kinds don't have. It is terrific not just for expanding a company, however likewise for conserving a company from going insolvent in times of need. Some companies (C corporations) are subject to double tax, various other company frameworks (S corporations) have tax obligation advantages, depending on just how their earnings is distributed.Any type of earnings marked as owner income will certainly undergo self-employment tax, whereas the remainder of the service returns will be strained at its own degree (no self-employment tax obligation). A company is except everyone, and also it might wind up costing you even more money and time than it's worth. Prior to coming to be a company, you should know these prospective disadvantages: There is a lengthy application procedure, you must follow inflexible rules and click reference procedures, it can be expensive, and also you may be dual exhausted (relying on your company framework).

There are a number of kinds of corporations, including C corporations, S corporations, B corporations, shut firms and also not-for-profit firms. Some choices to firms are single proprietorships, collaborations, LLCs as well as cooperatives. (C-corp) can have an endless number of investors and also is taxed on its income as a separate entity.

Report this wiki page